Printable Map Activities – free printable map activities, free printable map activities for first grade, free printable map activities worksheets, Maps is surely an important supply of principal details for historical research. But what exactly is a map? This really is a deceptively basic question,…

Printable Map Of Iraq

Printable Map Of Iraq – free printable map of iraq, printable map of iraq, printable outline map of iraq, Maps is definitely an essential supply of main details for historical analysis. But what is a map? It is a deceptively simple concern, till you are…

Printable Map Of Las Vegas Strip

Printable Map Of Las Vegas Strip – printable las vegas strip map 2016, printable map of las vegas strip, printable map of las vegas strip 2019, Maps is an crucial source of major info for traditional analysis. But what is a map? This can be…

India Map Printable Free

India Map Printable Free – india map printable free, india outline map free printable, Maps is surely an crucial way to obtain principal info for traditional analysis. But what is a map? This is a deceptively easy query, before you are inspired to provide an…

Printable Map Of Rome City Centre

Printable Map Of Rome City Centre – printable map of rome city centre, printable street map of rome city centre, Maps is definitely an crucial supply of principal details for historic investigation. But what is a map? It is a deceptively simple question, until you…

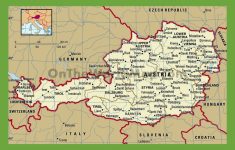

Printable Map Of Austria

Printable Map Of Austria – free printable map of germany and austria, printable map of austria, printable map of germany and austria, Maps is surely an essential way to obtain main info for historical analysis. But what exactly is a map? This is a deceptively…

Printable Map Of Cyprus

Printable Map Of Cyprus – free printable map of cyprus, printable map of cyprus, printable map of paphos cyprus, Maps is definitely an essential supply of principal information and facts for traditional examination. But just what is a map? This really is a deceptively easy…

Free Printable Map Of Ireland

Free Printable Map Of Ireland – free printable blank map of ireland, free printable map of dublin ireland, free printable map of ireland, Maps is definitely an crucial source of main details for traditional research. But what is a map? This really is a deceptively…

Blank Map Of Central And South America Printable

Blank Map Of Central And South America Printable – blank map of central and south america printable, blank map of latin america printable, Maps can be an essential method to obtain primary details for traditional research. But exactly what is a map? This is a…

Downtown Spokane Map Printable

Downtown Spokane Map Printable – downtown spokane map printable, Maps is definitely an essential source of principal info for traditional analysis. But what is a map? This really is a deceptively easy concern, before you are required to offer an respond to — it may…